Introduction:

Bank routing numbers are essential for various financial transactions, including direct deposits, wire transfers, and ACH transfers. Knowing how to research and find your bank's routing number, as well as understanding how to use it correctly, is crucial. In this guide, we will walk you through the process, ensuring you have all the information you need for successful transactions.

1. Understanding Bank Routing Numbers:

Bank routing numbers, also known as routing transit numbers (RTNs), are unique nine-digit codes assigned to financial institutions in the United States. They help identify the specific bank and its branch. Each bank and branch may have its own routing number.

2. Researching Your Bank's Routing Number:

Finding your bank's routing number is relatively straightforward. Here are some methods you can use:

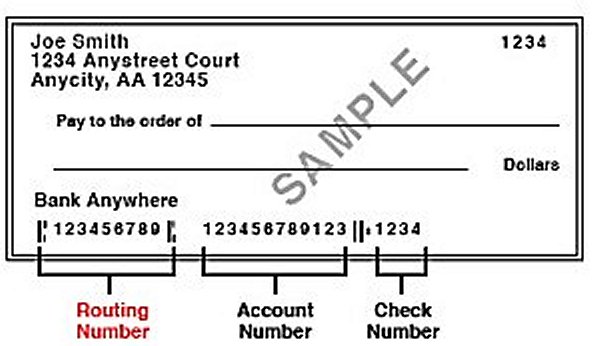

Check your checks:

Look at the bottom left corner of your personal checks. The routing number is typically printed there.

Online banking:

Log in to your online banking account. The routing number is often displayed in the account details or settings section.

Bank's website:

Visit your bank's official website and navigate to the customer support or FAQ section. Search for information related to routing numbers.

3. Verifying the Routing Number:

It's essential to verify the accuracy of the routing number before using it for any transactions. You can do this in the following ways:

Contact your bank:

Reach out to your bank's customer service via phone, email, or chat to confirm the routing number associated with your account.

Online tools:

Use reputable online resources or routing number directories to verify the routing number. These tools often provide up-to-date information and can help ensure accuracy.

4. Using the Routing Number:

Now that you have found and verified your bank's routing number, let's explore how to use it effectively:

Direct deposits:

When setting up direct deposit for your salary or other payments, provide your employer or payment provider with your bank's routing number and your account number.

Wire transfers:

For domestic wire transfers, include your bank's routing number, your account number, the recipient's bank name, and the recipient's account number. Be sure to double-check all the information to prevent errors.

ACH transfers:

Similar to direct deposits, provide the routing number and account number to initiate ACH transfers for bill payments, online transactions, or transferring funds between accounts.

5. International Transactions and Routing Numbers:

Bank routing numbers are specific to the United States and cannot be used for international transactions. International transfers often require additional information, such as SWIFT codes or International Bank Account Numbers (IBANs). Contact your bank to obtain the necessary details for international transfers.

6. Keeping Routing Numbers Secure:

While routing numbers are not considered highly sensitive information, it's still important to keep them secure. Avoid sharing your routing number with unknown or untrusted entities. Only provide it to trusted sources for legitimate transactions.

Conclusion:

Understanding how to research and find your bank's routing number and how to use it correctly is essential for smooth and successful financial transactions. By following the steps outlined in this guide, you can confidently navigate the process and ensure accurate and secure transfers. Remember to verify the routing number, use it appropriately for the specific transaction type, and keep your routing number secure. If you ever have any doubts or need further assistance, don't hesitate to reach out to your bank for guidance.